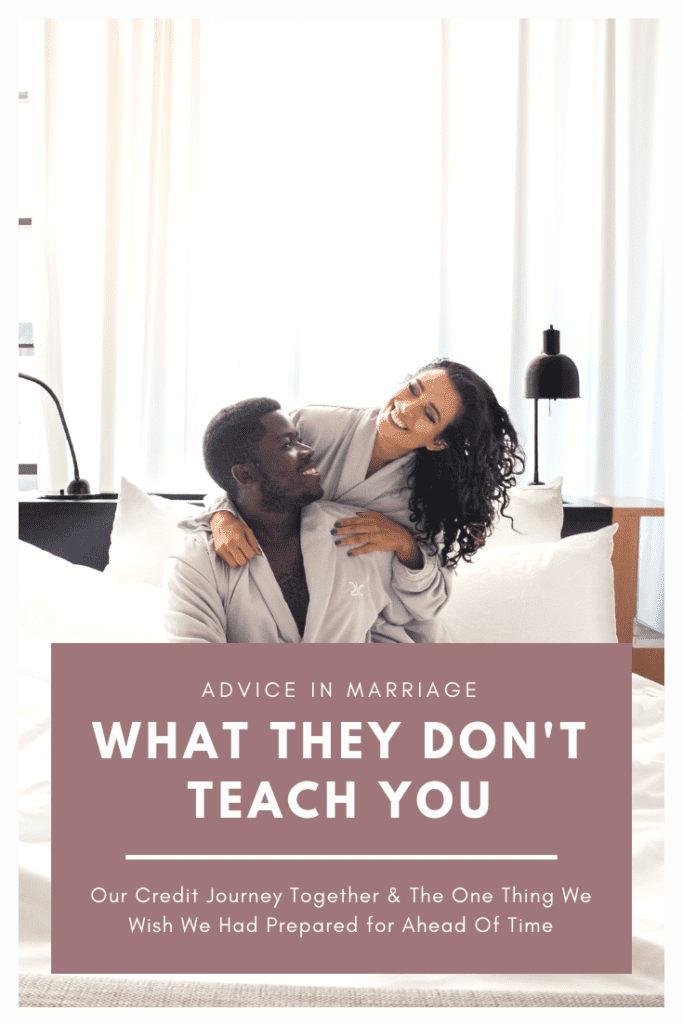

We took the marriage counseling classes. We thought we were as prepared as we could be. No one told us about this one thing that could affect our future.

That one thing is credit. It affects your ability to purchase a car, purchase a house, and even get small loans and credit cards. Chief and I had talked credit before. Neither of us were irresponsible and so we thought we had nothing to worry about.

I had spent longer building up credit. At the beginning of college I got a credit card and used it. The key was to only spend money that I had and then pay it back immediately. By the end of the four years of college I had built up a decent line of credit. While we knew Chief didn’t have much of a credit history we were absolutely shocked with what we found. Something we are still fighting a year later.

At first Chief wasn’t getting approved for credit cards and we assumed it was a lack of credit. Then we did some digging and found something worse. In the years of not building up credit, his account had gone by unnoticed by us, but not untouched. Someone had actually applied for credit in his name and failed to pay it off. What that left was a big red warning sign all across his credit history. It didn’t help that it was several years old because he had never paid attention to the credit.

A Year Later and Still Beyond Our Control

As soon as we found out about it, we sought to dispute it. Months passed by with no word. Then we had to submit for a second attempt. A year later nothing has changed. We just don’t have the knowledge, resources, or ins with the bureaus to do this alone.

Acts such as The Fair Credit Reporting Act (FCRA), Fair Credit Billing Act (FCBA), Fair Debt Collections Practices Act (FDCPA), and more give consumers the legal right to dispute inaccurate items on their credit reports. However, we don’t know all the ins and out of these acts. Without this we’ve made no progress and realize we need additional help. Lexington Law Firm understands these laws and is the advocate we need to help us understand our rights and use the law to fix this credit error.

What We Can Do

Despite this unfortunate discovery, we have been working together to overcome this. Chief took out a small college loan as well as a beginner’s credit card. We’ve had to be diligent to avoid extra fees on the card and to make sure to pay off the loans in time. Along the way, Lexington Law Firm is a resource for building up credit while we fix this issue. His credit score has been rising, although even with a higher credit score, that credit mark has really hurt a lot of progress.

We’ve come to realize that it’s beyond us at this point. Despite it not being our fault, we are dealing with the consequences and seeking the means to fix it. Improving credit takes time, but it can be done. Everyone has the right to good credit and the law is on our side to fix this with a little help.

How Lexington Law Firm Can Help

Lexington Law Firm is the oldest and most respected name in credit repair, and the only player in the category with the legal experience and technology to both advocate and drive results for consumers. They also have long-standing relationships with all three of the credit bureaus. These relationships mean they are able to help people with errors more efficiently and advocate for us in a way we can’t for ourselves. If you’re dealing with something similar, reach out Lexington Law Firm as soon as possible to get it fixed.

If you haven’t paid attention to your credit, now is a good time to call Lexington Law Firm for a FREE credit consultation where they can help identify anything strange or just help start building up credit. Don’t wait like we did. You can call now for your free consultation: 1-866-713-1930

Whether you’re about to apply for your first credit card, are still unsure how this whole credit thing works, or feel like a credit expert, Lexington has the resources to help with prices as low as $24.95 a month.

Last Updated 3 months ago by Jessica Serna | Published: June 21, 2019